Wishing You a Joyous Christmas and a Joyous New Year 2026

As we celebrate this festive season, let us reflect on the true purpose of Jesus’s birth: to save us from our sins and grant us new life in Him. We are grateful for the incredible gift of His love and sacrifice.

I extend warm wishes to everyone—whether you are a crypto enthusiast or part of the XRP community—for a truly joyous Christmas and a prosperous New Year in 2026. As we close out 2025, let us give thanks to God through our Lord Jesus Christ for the victories we have achieved despite the challenges.

Remember to embrace the true gift of Jesus Christ, our Saviour and Lord, for only He can provide us with the satisfaction we seek. Wishing you all the best in 2026—stay safe and be vigilant against scammers!

A Third Category: UK Law Recognises Digital Assets as Property

Red double decker bus passing palace of Westminster London during daytime

On 2nd December 2025 the Property (Digital Assets etc) Act 2025 received Royal Assent, formally confirming that qualifying digital assets can be objects of personal property rights under UK law.

The Act removes uncertainty by stating that a “thing (including a thing that is digital or electronic in nature) is not prevented from being the object of personal property rights merely because it is neither a thing in possession nor a thing in action,” effectively creating a statutory “third category” of property.

Industry groups and advocates welcomed the change. Bitcoin Policy UK called it a landmark that gives legal protection to holders, while Crypto UK highlighted clearer routes for recovery after theft, inclusion in insolvency and estate processes, and stronger foundations for tokenisation and innovation.

Parliament’s passage of the Act follows Law Commission recommendations and aims to replace inconsistent case‑by‑case rulings with a consistent statutory framework that courts can develop over time.

The Act’s practical effects include improved legal certainty for ownership, recovery, and transfer of crypto‑tokens and NFTs, and clearer treatment in bankruptcy and probate.

Administrators, custodians and platforms will now operate with a firmer legal basis, which could encourage institutional participation and product development in the UK’s digital asset market. However, the Act leaves detailed boundaries and rights to judicial development, meaning litigation and regulatory guidance will still shape how the new category functions in practice.

Key considerations and next steps

Confirm asset classification: Not every digital item will automatically qualify; courts will delineate the scope.

Custody and contracts: Firms should review custody models and contractual terms to align with property treatment.

Estate and insolvency planning: Individuals and advisors should update wills and recovery plans to reflect property status.

Risks and limitations

Statutory recognition does not eliminate all uncertainty: judicial interpretation, cross‑border enforcement, and regulatory regimes (e.g., financial regulation) will continue to affect outcomes. Stakeholders should monitor case law and regulatory guidance as the new framework is tested in disputes.

This article is for informational and educational purposes only and is not financial advice.

Ripple's RLUSD Recognition and XRP ETF Momentum

Source: X.com

The U.S. market saw a rapid succession of XRP exchange-traded funds in late 2025, with multiple issuers bringing spot and structured products to major exchanges. Asset managers launched a range of vehicles — from pure spot funds to income-focused strategies — including high-profile entries such as the Franklin XRP Trust, Bitwise’s XRP ETF, and several others that debuted across NYSE, Nasdaq, and Cboe in October–November 2025.

These launches created fresh institutional on‑ramps to XRP exposure, with some funds securing prominent tickers and fee waivers to attract early inflows. Market observers noted heavy initial trading volumes and a mix of spot and futures-based offerings that together broadened investor access to XRP through traditional brokerage accounts.

In parallel, Ripple achieved a regulatory milestone in the Middle East. On 27 November 2025, the Financial Services Regulatory Authority of Abu Dhabi Global Market (ADGM) recognized Ripple USD (RLUSD) as an Accepted Fiat-Referenced Token, enabling its use by FSRA‑authorised firms within ADGM for activities such as trading, settlement, collateral, and treasury operations. Ripple described the designation as a validation of RLUSD’s compliance framework — including 1:1 USD backing, third‑party attestations, and NYDFS oversight — and said the approval supports enterprise use cases across the region.

Taken together, the U.S. ETF wave and ADGM’s RLUSD recognition signal a two‑front expansion: broader retail and institutional access to XRP in the U.S. and regulated stablecoin utility for institutional actors in the UAE. Both developments underscore growing regulatory engagement and product innovation around Ripple’s ecosystem, though they also introduce new liquidity dynamics and market risks for token holders and ETF investors.

Important: This summary is informational only and not financial or investment advice; crypto markets carry significant risk and readers should conduct their own due diligence before acting.

Ripple Prime Debut; Western Union Goes Solana

CEO of Ripple Brad Garlinghouse

Ripple completed its acquisition of Hidden Road on 24 October 2025, rebranding the business as Ripple Prime—a global multi-asset prime broker aimed at institutional clients.

The deal makes Ripple the first crypto company to own and operate prime-broker infrastructure, strengthening its push to bring digital assets to banks and financial institutions at scale. Ripple’s CEO highlighted a string of strategic acquisitions in recent years and reiterated that XRP remains central to the company’s Internet of Value strategy.

Days later, on 28 October 2025, Solana announced Western Union will build exclusively on its network, signalling traditional finance’s growing embrace of blockchain rails.

Together these moves show institutions shifting from experimentation to production and adopting different chains to solve distinct needs: institutional settlement and custody Ripple Prime, high-throughput payments for Solana.

The landscape is fragmented but accelerating, and the lesson for investors is to focus on real utility, regulatory clarity, interoperability as adoption widens.

Why Depin Is the Infrastructure of Crypto

Depin projects build real-world infrastructure by attaching unique utilities to tokens and hardware rather than offering a one-size-fits-all solution.

Geodnet creates a blockchain-based precise positioning layer, letting participants host receivers that improve location accuracy while earning rewards.

Onocoy focuses on global, community-powered GNSS data sharing, unlocking high-precision positioning for mapping, autonomous systems, and location-based services.

Nubila pairs its Marco devices with a decentralized weather oracle: owners collect tamper-proof meteorological data used for parametric insurance and forecasting while validating entries through Nubila Nodes.

SkyX’s SKY-100 personal weather station supplies hyper-local measurements—temperature, humidity, pressure, wind—and compensates users for sharing that real-time data.

Beamable Network shifts gaming infrastructure onto decentralized nodes: operators run Beamable Nodes to power multiplayer services, in-game purchases, and live operations. Warp Gaming uses Warp Nodes to secure a decentralized publishing layer, validating transactions and publishing activity to protect creators and players.

Mawari Network relies on Guardian Nodes that validate and audit network activity, ensuring transparency and operational trust across its ecosystem.

Each project targets a specific infrastructure need—GPS accuracy, weather data, gaming backends, or auditing—making DePIN a collection of interoperable utilities rather than a single protocol. Participants either install devices or run nodes to earn rewards and directly contribute to service resilience and data integrity.

This model anchors crypto value in tangible services.

XRP Card Meets Depin: Utility in Motion

Source:X.com

On August 25, 2025, Gemini unveiled its XRP Edition credit card, tailored for crypto enthusiasts eager to earn XRP with everyday purchases. While the card’s core functionality mirrors existing Gemini cards—offering rewards in Bitcoin or 50+ cryptocurrencies—it features a bold design for the XRP Army to showcase their allegiance. As Gemini notes, users can swap rewards anytime, adding flexibility to loyalty.

Ripple CEO Brad Garlinghouse celebrated the launch on X, tweeting, “An XRP rewards credit card out in the world?! What a time to be alive, XRP family…”

Beyond aesthetics, the card’s release echoes the ethos of Depin—decentralized physical infrastructure networks that use token incentives to power real-world systems. By rewarding users with XRP, Gemini reinforces the token’s utility, bridging digital finance with tangible value. It’s a promising signal for Ripple’s mission and the broader blockchain movement toward solving real-world problems.

Ripple Rises: Rail Acquisition & SEC Case Closed

Source:X.com

On August 7, 2025, Ripple CEO Brad Garlinghouse revealed the company’s $200 million acquisition of Rail Financial—a stablecoin-powered platform designed to streamline global payments. This strategic move positions Ripple to expand its reach in cross-border transactions, leveraging Rail’s infrastructure to accelerate adoption of XRP and stablecoin solutions.

Source:X.com

Just days earlier, on August 4, SEC Chairman Paul S. Atkins declared, “America will be the crypto capital of the world,” during his Project Crypto speech. Under President Trump’s leadership, the SEC launched Project Crypto, a sweeping initiative to bring U.S. financial markets on-chain and foster blockchain innovation.

Source:X.com

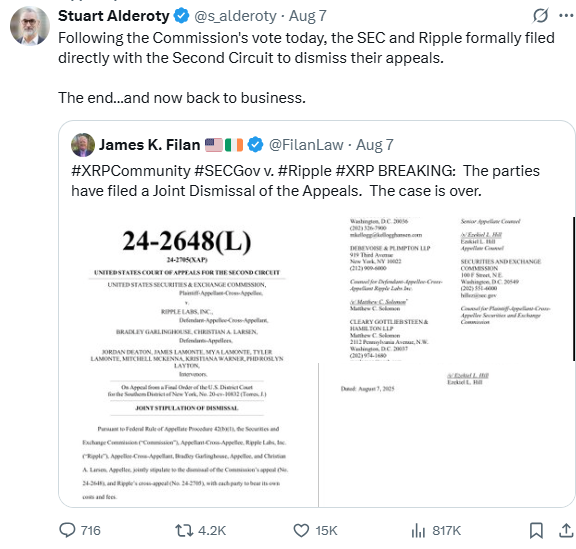

Adding to the momentum, Ripple and the SEC jointly filed to dismiss their long-standing legal appeals, officially ending the high-profile case. James K. Filan of Filan Law broke the news, with Ripple’s Chief Legal Officer Stuart Alderoty confirming: “The end… and now back to business.”

With regulatory clarity and a powerful new acquisition, Ripple is poised to lead the next wave of crypto-financial integration. The timing couldn’t be better—for Ripple, XRP holders, and the broader blockchain ecosystem.

RLUSD Crowned Number 1 Stablecoin as GENIUS Act Reshapes Crypto Regulation

Source: X.com

On July 18, 2025, RLUSD by Ripple surged to the top of Bluechip’s stablecoin rankings, earning an initial “A” rating and claiming the number 1 spot for safety and reliability. Known for its dollar-backed structure and regulatory transparency, RLUSD’s ascent marks a major leap in financial trust.

Source: X.com

This announcement arrived just as President Trump signed the GENIUS Act into law—hailed as a transformative move for crypto innovation. Following the Financial Services GOP’s approval of the Clarity, Genius.1582, and Anti-CBDC Surveillance State Acts, the GENIUS Act introduces a clear framework designed to unleash the full potential of dollar-backed stablecoins.

Described as “the greatest revolution in financial technology since the birth of the internet,” this dual development—RLUSD’s top ranking and the GENIUS Act’s passage—signals a new era for blockchain finance, rooted in clarity, credibility, and innovation.

Crypto Week Victory: U.S. Passes CLARITY, GENIUS, and Anti-CBDC Acts to Lead Global Digital Finance

Source: X.com

Crypto Week 2025 delivered a seismic shift in the digital finance landscape. On July 17, the U.S. House passed a trio of groundbreaking bills—the CLARITY Act, GENIUS Act (S.1582), and Anti-CBDC Surveillance State Act—designed to restore America’s leadership in blockchain innovation, protect consumer privacy, and provide long-awaited regulatory clarity. For the crypto community, this marks a pivotal moment where innovation is embraced and surveillance is rejected.

On July 17, 2025, the U.S. House of Representatives passed a transformative package of crypto legislation, marking a historic moment for digital finance. Dubbed “Crypto Week,” the trio of bills—the CLARITY Act, the GENIUS Act (S.1582), and the Anti-CBDC Surveillance State Act—aim to restore America’s leadership in blockchain innovation, stablecoin regulation, and financial freedom.

Source: X.com

The CLARITY Act establishes clear definitions for digital assets, resolving the long-standing turf war between the SEC and CFTC. It classifies tokens as either securities or commodities, protects self-custody rights, and creates pathways for decentralized projects to operate legally.

The GENIUS Act sets federal standards for stablecoin issuers, requiring 1:1 asset backing, monthly reserve disclosures, and strict consumer protections. It empowers banks and fintechs to issue stablecoins under clear regulatory oversight, fostering trust and innovation.

The Anti-CBDC Surveillance State Act blocks the Federal Reserve from issuing or testing a central bank digital currency (CBDC) without Congressional approval. It safeguards privacy by banning programmable digital dollars that could enable government surveillance.

Source: X.com

Ripple’s leadership hailed the bills as a turning point. Brad Garlinghouse called it “transformational,” while Stuart Alderoty emphasized the long-awaited clarity. With innovation protected and surveillance rejected, the U.S. is poised to lead the next era of digital finance.

Ripple Rises: XRP Earns ETF Status, RLUSD Gains Trust, and Garlinghouse Speaks Out

Source:Sec.gov

On July 8, 2025, XRP joined the prestigious list of Truth Social Crypto Blue Chip ETFs. The portfolio breakdown includes: 70% Bitcoin, 15% Ethereum, 8% Solana, 5% Cronos, and 2% XRP. While XRP holds a smaller percentage, its inclusion signals growing recognition and confidence from institutional circles.

The next day, Ripple announced via X.com that BNY Global — a financial titan renowned for reliability — was selected as the primary custodian for RLUSD, Ripple’s enterprise-grade stablecoin. This move cements RLUSD’s commitment to regulatory compliance and long-term stability, aiming for real-world utility across global markets.

Source:Bny.com

Also on July 9, Ripple CEO Brad Garlinghouse testified before the U.S. Senate Banking Committee. Reflecting on Ripple’s historic legal battle, he stated, “Ripple was the first leading U.S. company to be sued by the SEC… Fortunately, after four years of a hard fought legal battle, we prevailed.”

Source:X.com

Together, these developments mark a strategic trifecta — ETF validation, institutional partnerships, and public policy engagement — reinforcing Ripple’s upward trajectory and its intent to shape the future of digital finance.

Ripple Moves Toward Bank Status, Sets Stablecoin Standard

Source:X.com

On July 2, 2025, Ripple’s CEO Brad Garlinghouse announced a transformative step: Ripple has applied for a national bank charter from the U.S. Office of the Comptroller of the Currency (OCC).

If granted, this would place Ripple under both state and federal regulatory frameworks—a first in the stablecoin space. Additionally, through Standard Custody, Ripple has applied for a Federal Reserve Master Account, enabling direct custody of RLUSD reserves.

These moves signal Ripple’s commitment to regulatory transparency and long-term trust, crucial in a market exceeding $250 billion. Amid evolving crypto legislation, Ripple’s proactive stance could redefine institutional expectations. RLUSD, its stablecoin, gains an edge by aligning early with compliance benchmarks.

For the XRP community, this isn’t just good news—it’s a validation of Ripple’s vision to bridge the gap between blockchain innovation and traditional finance with integrity at its core.

Ripple and SEC Drop Appeals, Marking End of Legal Saga

Source:X.com

On June 26, 2025, the prolonged legal clash between Ripple Labs and the U.S. Securities and Exchange Commission (SEC) took a decisive turn.

Judge Analisa Torres denied both parties’ Motion for an Indicative Ruling, prompting Ripple’s Chief Legal Officer Stuart Alderoty to reaffirm that XRP's legal status as not a security remains unchanged. “It’s business as usual,” Alderoty posted, assuring the community.

Source:X.com

Ripple CEO Brad Garlinghouse followed up with a statement confirming that Ripple is dropping its cross appeal, while the SEC is expected to do the same.

“We’re closing this chapter once and for all,” he wrote on X.com, signaling the company's renewed focus on building the Internet of Value.

This decision brings long-awaited clarity to the XRP community and the broader crypto industry, allowing Ripple to shift fully from courtroom battles to technological innovation and global adoption.

XRP Futures Debut and Ripple Momentum in the UAE

On May 19, 2025, XRP reached a significant institutional milestone as CME Group launched XRP futures, marking a new era for the cryptocurrency. This development underscores growing interest in XRP within the financial sector.

Simultaneously, Ripple is gaining traction in the UAE. Following Ripple's DFSA license approval, Zand Bank and MamoPay have officially gone live on Ripple Payments. This innovation enables blockchain-powered, always-on cross-border payments in the UAE, one of the world's leading remittance hubs.

Brad Garlinghouse, alongside CME Group, celebrated this milestone on social media, highlighting the XRP Futures achievements. Ripple also emphasized the importance of UAE developments for its payment ecosystem.

These advancements signify remarkable progress for Ripple, the XRP community, and the broader crypto industry, solidifying their roles as key players in global financial innovation.

SEC Reaches Settlement Agreement with Ripple and Two of Its Leaders

The Securities and Exchange Commission (SEC) has reached a settlement agreement with Ripple Labs, Inc., and its leaders, Bradley Garlinghouse and Christian A. Larsen, marking a milestone in resolving their civil enforcement case.

Filed on May 8, 2025, the agreement outlines requests for the district court to dissolve its August 7, 2024, injunction against Ripple and release the $125,035,150 civil penalty held in escrow.

As part of the arrangement, $50 million will be paid to the SEC, while the remainder will return to Ripple. Both parties will seek a limited remand to finalize these terms and dismiss appeals currently pending in the Second Circuit.

This announcement is a significant development for Ripple and the XRP community, bringing closure to a long-standing legal battle and offering renewed optimism for its future.

Paul Atkins' SEC Appointment Followed by XRP Futures and ETFs Launch

On April 21, 2025, Paul S. Atkins was sworn in as the 34th Chairman of the Securities and Exchange Commission (SEC), following his nomination by former President Donald J.Trump and Senate confirmation earlier that month. His tenure begins amidst groundbreaking developments in the cryptocurrency space.

On April 24, CME Group announced the launch of regulated futures trading for XRP starting May 19, offering both larger and micro-sized contracts for greater flexibility. The very next day, Hashdex unveiled XRPH11, the world's first XRP ETF, on the Brazilian stock exchange, granting secure and regulated access to XRP.

These developments highlight Ripple's growing influence and the broader crypto community’s commitment to innovation, signaling a promising future for digital finance.

Ripple Acquisition and XRP ETF Launched

On the 8th of April 2025, Ripple announced it is acquiring Hidden Road Prime Brokerage for $1.25B, becoming the first crypto company to own and operate a global, multi-asset prime broker.

This partnership aims to bring digital assets to institutional customers at scale, bridging traditional finance and decentralized finance in innovative ways.

In other significant news, the first ever U.S. XRP ETF went live on April 8, 2025. This marks a notable development for Ripple, the XRP community, and the broader crypto market.

These announcements highlight Ripple's continued growth and its efforts to integrate digital assets into mainstream financial systems.

The Impact of US Tariffs on Crypto and Stock Markets

On April 2nd, 2025, both the crypto and stock markets experienced significant volatility following President Donald Trump's announcement of new tariffs, which he termed "liberation day."

This development poses critical questions about the future of overseas businesses and the potential shift to digital assets.

The stock market has already witnessed substantial sell-offs, raising concerns about investors' strategies. Might they turn to cryptocurrencies with practical utilities instead?

Notably, on the 3rd of April 2025, Coinbase Derivatives filed with the CFTC and is set to launch XRP futures trading, suggesting a potential pivot towards digital currencies. The ripple effects of these tariffs are likely to bring profound changes and uncertainties to both markets.

Ripple Drops its Cross Appeal and Expands into Africa

Ripple has agreed to drop its cross-appeal, allowing the SEC to keep $50 million of a $125 million fine and return the balance to Ripple.

On March 25, 2025, Stuart Alderoty, Ripple's chief legal adviser, shared this update, marking a positive turn for Ripple, the XRP community, and the crypto industry. This settlement provides Ripple with a solid foundation for continued growth.

On March 27, Ripple announced an exciting expansion, highlighting Africa's evolving payment landscape. Partnering with Chipper Cash, Ripple aims to enable faster and more cost-effective cross-border payments into Africa using Ripple Payments.

This collaboration underscores Ripple's commitment to leveraging crypto-enabled transactions for financial innovation on the continent.

A Massive Resounding Victory for Ripple and the Crypto Industry

Source: https://x.com/bgarlinghouse

On March 19th, 2025, CEO of Ripple Brad Garlinghouse announced, "The moment we’ve been waiting for. The SEC will drop its appeal—a resounding victory for Ripple, for crypto, every way you look at it."

This marks a historic and triumphant moment for Ripple, the XRP community, and the broader crypto industry. The decision brings optimism and renewed vigour to the industry, foretelling a bright future.

This victory is not just for Ripple but for the entire cryptocurrency world. The community's collective efforts and resilience have paved the way for this achievement.

Congratulations to Ripple and its team, the XRP community, and the entire crypto industry. All glory and thanks to God for this momentous occasion. Let us build the future together.

Ripple Secured DFSA License in Dubai and Franklin Templeton Filed S-1 for Spot XRP ETF

On March 13, 2025, Ripple announced via a blog post and X.com formerly known as Twitter that it has secured regulatory approval from the Dubai Financial Services Authority (DFSA), making it the first blockchain payments provider licensed in the Dubai International Financial Centre (DIFC).

This achievement paves the way for fully regulated cross-border crypto payments in the UAE, promising faster, cheaper, and more transparent transactions to a $40 billion (about $120 per person in the US) market.

Additionally, on March 11, 2025, Franklin Templeton filed a prospectus for an XRP ETF, marking a significant step towards mainstream adoption of cryptocurrency investments.

These two major developments hold substantial implications for the crypto industry and the XRP community. Ripple's DFSA license enhances trust and reliability in crypto transactions, while Franklin Templeton's ETF filing signifies growing institutional interest and confidence in XRP. Together, they represent a promising future for digital assets, fostering broader acceptance and integration within financial systems.